Schedule a demo with us

We can help you solve company communication.

Simplify benefits and impact people’s lives. our integrated solutions help build better benefits packages.

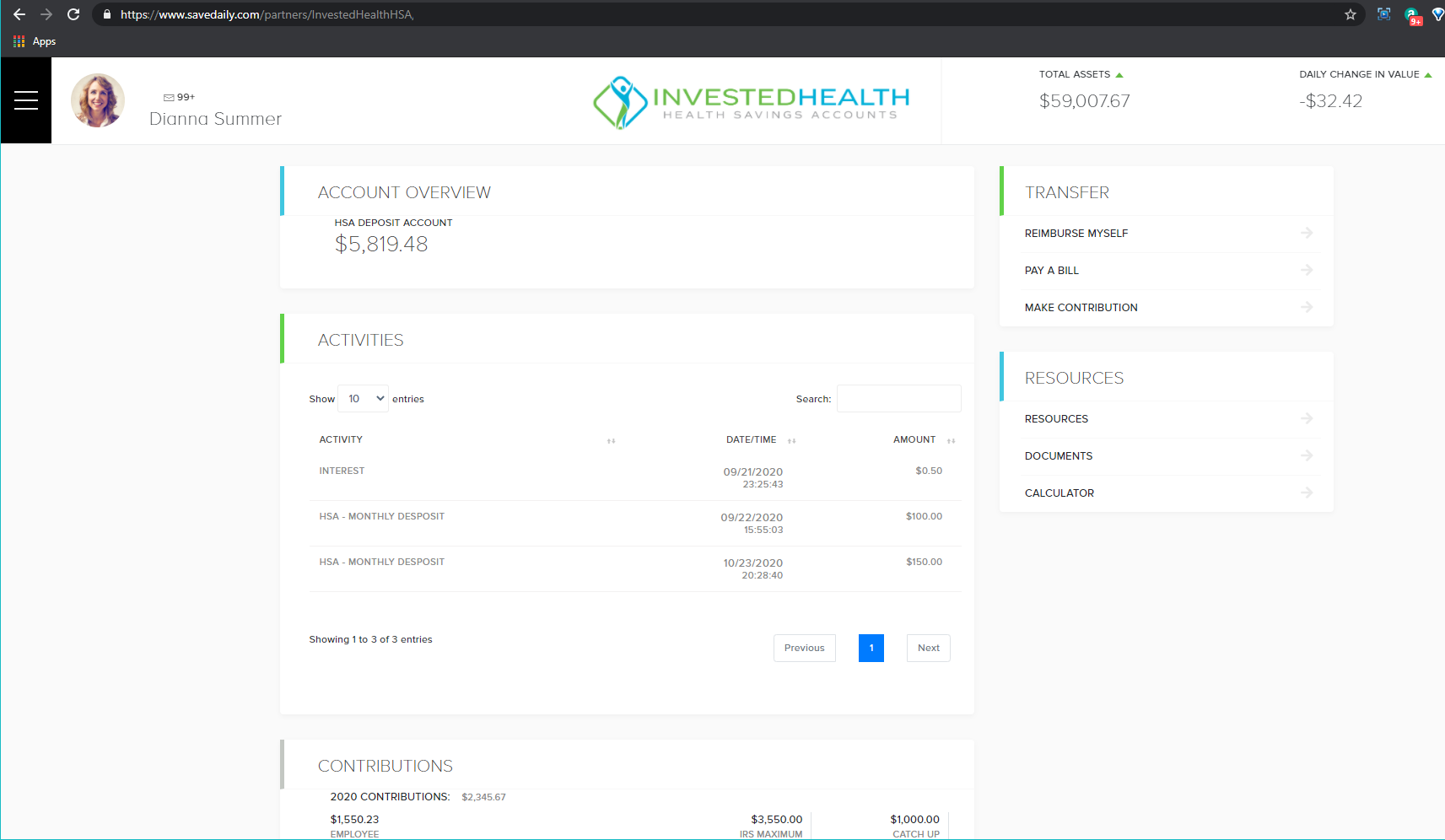

Schedule a demo Open business accountEfficiently review and manage all administrative tasks online in one comprehensive dashboard view.

Sign up nowYour dedicated onboarding specialist will help customize your setup and provide support, even after open enrollment.

Sign up nowInvestedHealth offers contribution and enrollment management solutions that meet your needs.

Sign up nowManage your companies HSA 100% online from our simple employer dashboard.

Active users

Data breaches

Global uptime

Terabytes

Add your emplyee names, emails and plan effective dates. We'll take care of the rest.

Our sign up is dead simple. We only require your basic company information and what type of data storage you want.

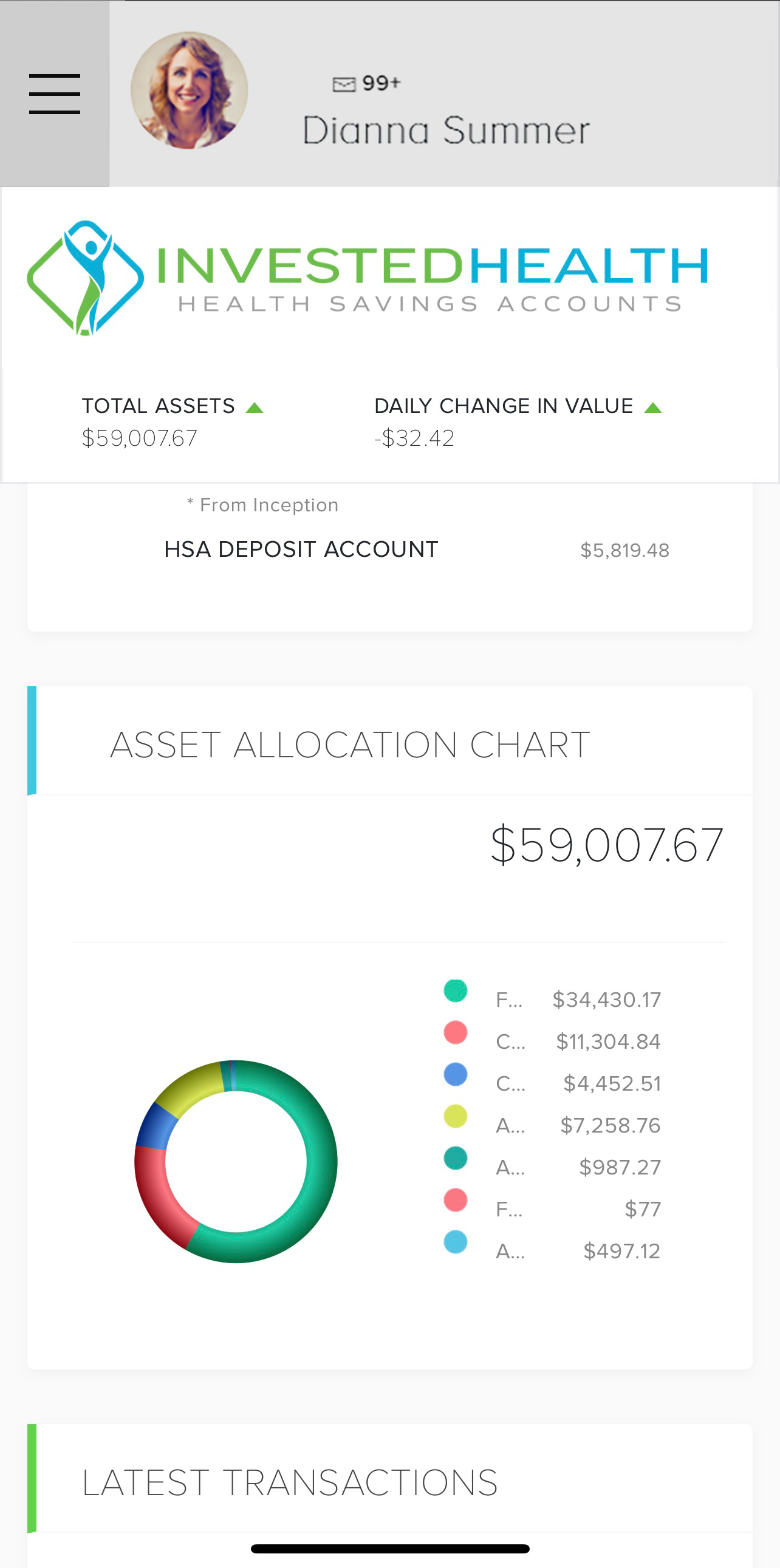

We offer tools that will help your employees determine how their HSA will grow over time or determine what is eligible.

Effortlessly manage funding via dashboard, secure files, or integrated solutions.

We are committed to offering no-fee HSAs to help make sure you get the most from your health care savings.

Individual

We offer variable pricing with discounts for larger organizations. Click here to learn more about our flexible business packages.

per employee

No hidden fees

Secure contributions

Instant transfers

Tax free saving

No minimum cash balances

A Health Savings Account (HSA) is a tax-advantaged checking account that gives you the ability to save for future medical expenses or pay current ones.

To be eligible for a Health Savings Account, an individual must be covered by a High Deductible Health Plan (HDHP), must not be covered by other non-HDHP health insurance, must not be enrolled in Medicare and can’t be claimed as a dependent on someone else’s tax return.

Effortlessly manage funding via dashboard, secure files, or integrated solutions.

Unused funds remain in the account from year to year and there is no “use it or lose it” provision. If you do not have to use your HSA funds for current medical expenses, you can save it for future use.

Make the most of your healthcare savings while working towards your financial goals.

Create account